Introduction: Why Saving Money is Your Financial Superpower

Saving money isn’t about deprivation; it’s about reclaiming control over your income and steering your financial ship exactly where you want it to go. Whether you’re aiming to pay off debt, build an emergency fund, or save for a dream vacation, finding those extra dollars each month is crucial.

The good news? You don’t need a huge pay raise to make a difference. Small, consistent changes across different areas of your life can add up to thousands of dollars in savings over a year.

At MoneySeedHub.com, we believe financial well-being is achievable for everyone. This comprehensive guide, “50 Ways to Save Money Every Month,” is your toolkit for transforming your finances, one small victory at a time. Get ready to supercharge your savings habit!

💡 Phase 1: Mastering Your Budget and Cutting Fixed Costs

The biggest savings often come from tackling the largest, most consistent expenses. These are the bills you pay automatically—your fixed costs.

Reviewing Essential Utilities and Subscriptions

Your monthly service providers are a prime place to find easy savings.

- 1. Negotiate Better Rates: Call your cable, internet, and mobile providers. Politely ask for a lower rate or mention you’re considering switching. Often, they have unadvertised loyalty plans.

- 2. Audit Your Subscriptions: Review your bank statement for recurring payments. Cancel services you rarely use (streaming, gym memberships, apps). Even a $15 subscription is $180 a year!

- 3. Lower Your Phone Plan: Do you really need unlimited data? Switch to a budget carrier or a lower-tier plan that meets your actual usage.

- 4. Go Paperless for Bills: Many companies offer small discounts (like $5) for switching to automatic, paperless billing.

- 5. Optimize Energy Use: Install a programmable thermostat and set it back a few degrees in winter or up a few in summer. Seal drafty windows and doors.

Saving on Housing Expenses

Housing is typically your largest expense, offering significant opportunities for savings.

- 6. Refinance Your Mortgage (If Rates Allow): If you’re a homeowner, research current interest rates. A lower rate can shave hundreds off your monthly payment.

- 7. Challenge Your Property Taxes: Research what your neighbors pay. If you believe your home is over-assessed, file an appeal.

- 8. Get a Roommate: If you have an extra room, bringing in a reliable roommate can cut your rent or mortgage, utilities, and internet costs in half.

- 9. Rent Out Storage Space: Use services that allow you to rent out your garage, basement, or attic space for extra income, effectively lowering your housing cost. (See our guide on Passive Income Ideas for Beginners.)

- 10. Downsize Your Home: A drastic, but highly effective move. Consider if your current home is truly necessary for your lifestyle.

🍎 Phase 2: Smarter Spending on Food and Groceries

The average household spends a surprising amount on food. This is an area where conscious effort yields immediate results.

Shopping Strategically

- 11. Meal Plan religiously: Before you go shopping, map out every meal for the week. Only buy ingredients for those specific meals.

- 12. Buy in Bulk (Only for Non-Perishables): Purchase items like paper goods, detergent, and frozen meats from warehouse clubs, but only if you have the space to store them and will use them before they expire.

- 13. Use Store Brand Products: For many staples (salt, sugar, oats, cleaning supplies), the store brand is chemically identical to the name brand, but significantly cheaper.

- 14. Shop with a List and Stick to It: Impulse buys in the checkout aisle derail budgets instantly. A list is your defense mechanism.

- 15. Use Loyalty Programs and Coupons: Don’t be too proud! Digital coupons and loyalty points are free money. Make it a habit to check the store app before you shop.

Cutting Food Waste and Dining Out

- 16. Pack Your Lunch: Bringing a meal from home rather than buying lunch (even just three times a week) can save you $150 or more a month.

- 17. Cook Large Batches (Batch Cooking): Cook once, eat three times. This saves on energy and reduces the temptation to order takeout. Freeze portions for quick, future meals.

- 18. Stop Buying Bottled Water: Invest in a quality water filter and a reusable bottle. This saves money and helps the environment.

- 19. Reduce Meat Consumption: Meat is often the most expensive item on a grocery bill. Try two or three vegetarian meals a week.

- 20. Use Up Leftovers: Make a “leftover night” mandatory once a week. Be creative—turn leftover chicken into tacos or an egg scramble.

🚗 Phase 3: Significant Transportation Savings

The costs associated with getting around—gas, insurance, maintenance—can be relentless.

Lowering Car Expenses

- 21. Shop for Cheaper Car Insurance: Get quotes from at least three different companies every year. Loyalty doesn’t always pay; switching can save you hundreds.

- 22. Drive Less: Combine errands into one trip. Walk, bike, or use public transport when possible.

- 23. Proper Tire Inflation: Properly inflated tires improve gas mileage and prolong the life of your tires.

- 24. Stick to the Speed Limit: Driving faster uses significantly more fuel. Maintain a steady speed.

- 25. Perform Basic Maintenance Yourself: Changing your own air filters and wiper blades is simple and saves the labor cost charged by mechanics.

Rethinking Your Commute

- 26. Carpool with Coworkers: Split the cost of gas and parking.

- 27. Use Public Transit Passes: If available, a monthly pass is usually far cheaper than the combined cost of gas, parking, and wear-and-tear.

- 28. Negotiate for Remote Work: If your job allows, even one or two days working from home a week saves on gas, food, and clothing expenses.

- 29. Sell Your Second Car: If you’re a multi-car household and one can be eliminated, you save on insurance, registration, maintenance, and the payment.

💳 Phase 4: Financial and Debt Strategies

These moves require a little effort, but the long-term benefit of reducing interest payments is huge.

Tackling High-Interest Debt

- 30. Pay More Than the Minimum: This is the most powerful way to reduce the amount of interest you pay over the life of a loan or credit card.

- 31. Debt Consolidation: Use a personal loan or a balance transfer credit card with a 0% introductory rate to combine high-interest debts. Crucial: Pay it off before the introductory rate expires.

- 32. Use the Debt Snowball or Avalanche Method: The Snowball method pays off the smallest debt first; the Avalanche method pays off the highest-interest debt first. Pick one and stick with it. (Read our deep dive on How to Get Out of Debt Fast.)

Banking and Credit Card Fees

- 33. Avoid ATM Fees: Use your own bank’s ATMs or get cash back during grocery purchases. Those $3–5 fees add up fast.

- 34. Use a High-Yield Savings Account (HYSA): Stop letting your money sit in a checking account that pays 0.01%. Move your emergency fund to an HYSA for better returns.

- 35. Stop Paying Credit Card Interest: If you carry a balance, find a way to pay it off in full every month. Interest payments are a pure drain on your savings.

🛍️ Phase 5: Lifestyle and Shopping Habits

Changing your daily habits and how you shop for non-essentials can uncover significant hidden savings.

Mindful Consumerism

- 36. Implement a “30-Day Rule”: For any non-essential purchase over a certain dollar amount (say, $100), wait 30 days before buying. Often, the urge passes.

- 37. Buy Quality Used Goods: Check out thrift stores, consignment shops, or online marketplaces for clothes, furniture, and electronics.

- 38. Swap or Borrow Instead of Buying: Need a ladder? Ask a neighbor. Need a formal outfit? See if a friend has one you can borrow.

- 39. Use the Library (Free Entertainment): Instead of buying books, DVDs, or paying for expensive streaming rentals, take advantage of the vast, free resources at your local library.

- 40. Start a Sinking Fund: Instead of scrambling to pay for big, expected expenses (like insurance premiums, holiday gifts, or car registration), set aside a small amount every month into a dedicated savings account.

Personal Care and Health

- 41. Do Your Own Manicure/Pedicure: Salon visits are costly. Learn to maintain your nails at home.

- 42. Switch to Generic or Bulk Over-the-Counter Meds: The active ingredients are the same; the cost difference is huge.

- 43. Exercise for Free: Ditch the expensive gym membership and use free resources like YouTube workout videos, running, or local parks.

- 44. Make Your Own Cleaning Supplies: Vinegar, baking soda, and water can replace most expensive, specialized household cleaners.

🎁 Phase 6: Earning and Unexpected Savings

Sometimes saving means making a little extra money or capturing unexpected windfalls.

- 45. Sell Unused Items: Declutter your home and list items on Facebook Marketplace or eBay. Treat the money as extra savings or debt payments.

- 46. Have a “No-Spend” Day or Weekend: Challenge yourself to spend absolutely zero dollars for a full 24 or 48 hours. This forces you to be creative.

- 47. Maximize Retirement Matches: If your employer offers a 401(k) match, contribute at least enough to get the full match. This is 100% free money.

- 48. Reduce Insurance Coverage: If you have an older car with low resale value, consider dropping comprehensive or collision insurance.

- 49. Use Cashback Apps/Credit Cards: Use credit cards that offer cash back on purchases, but only if you pay the balance in full every month.

- 50. Automate Your Savings: Treat your savings contribution like a bill. Set up an automatic transfer the day after payday to a separate savings account. If you don’t see it, you can’t spend it. This is arguably the most powerful way to guarantee savings.

The Power of Small Changes: Pros & Cons

| Aspect | Pros (Why It Works) | Cons (Potential Pitfalls) |

| Incremental Changes | Sustainable: Small adjustments are easy to maintain long-term. | Slow Start: Results might feel insignificant initially, causing discouragement. |

| Increased Awareness | Financial Mindfulness: You become aware of spending leaks and bad habits. | “Saving Fatigue”: Over-optimization can feel restrictive and lead to burnout. |

| Immediate Impact | Quick Wins: Cutting high-interest debt or cancelling subscriptions provides instant, noticeable relief. | Social Pressure: Your new habits (e.g., packing lunch) might conflict with friend/family spending habits. |

Key Takeaways for Guaranteed Savings

- Audit Everything: Go through your bank statements line-by-line to see exactly where your money is going.

- Prioritize Big Wins: Start by tackling the largest expenses first: housing, transportation, and food.

- Automate, Automate, Automate: Make savings automatic so you can’t talk yourself out of it.

- Track Your Progress: Seeing your savings grow is the best motivation to keep going.

Conclusion: Taking Control, One Step at a Time

Saving money isn’t a one-time event; it’s a financial lifestyle. This list of 50 ways to save money every month gives you a massive toolkit to start with. The goal is not to implement all 50 overnight, but to choose 5–10 that fit your life and commit to them for the next three months.

By making conscious decisions about where your money goes, you are building a more secure and flexible future for yourself. Start today—choose your first three ways, write them down, and watch your savings account flourish! For more tailored advice, check out our article on How to Build a Personalized Budget.

Frequently Asked Questions (FAQs)

What is the easiest way to start with the 50 ways to save money every month?

The absolute easiest way is to start with automating your savings (Tip #50) and auditing your subscriptions (Tip #2). Automating moves money before you can spend it, and canceling unused subscriptions gives you instant, recurring savings without changing your daily habits.

How can I ensure my money-saving habits stick long-term?

The key is to track your results and celebrate small victories. Focus on the “why”—what are you saving for? If you’re using these 50 ways to save money every month to fund a down payment, keep a picture of your goal home visible. Make the habit automatic, not reliant on willpower.

Should I focus on large cuts or small, daily savings?

You should do both! Focus your time first on the “big three” expenses (housing, food, transportation) for the most impact. After those initial, large adjustments, then consistently apply the smaller, daily methods (like packing lunch or using coupons) to maintain momentum.

Is it really possible to save money without a major lifestyle change?

Absolutely. Many of the 50 ways to save money every month are about optimization, not deprivation. For example, negotiating a lower insurance rate (Tip #21) or simply using the library (Tip #39) requires no change to your lifestyle, just a single action. Consistent small actions are highly effective.

——————————————————————————————————————————-

This is another excellent topic for MoneySeedHub.com! Starting the saving journey can feel overwhelming, so a comprehensive guide that breaks down the fundamentals will provide massive value and establish trust with new readers.

I will craft a fully original, human-sounding, and deeply insightful long-form article that meets all your SEO and EEAT requirements.

🚀 How to Save Money as a Beginner: Your Step-by-Step Starter Guide

Meta Description: New to saving? Learn how to save money as a beginner with this friendly, expert guide. Master budgeting, cut expenses, and build your emergency fund easily.

Introduction: Why Now Is the Perfect Time to Start Saving

Welcome! If you’re here, you’ve taken the most important step in your financial journey: the commitment to save. Learning how to save money as a beginner might seem complex, but the truth is, the fundamental concepts are simple, effective, and accessible to everyone.

At MoneySeedHub.com, we understand that starting can feel intimidating. You might be juggling student loans, an entry-level salary, or simply trying to figure out where your paycheck vanishes each month. Forget the complicated jargon. This guide is your friendly, expert roadmap, designed to help you build smart saving habits from the ground up, turning financial anxiety into confidence.

Saving money isn’t about becoming rich overnight; it’s about giving yourself choices, security, and the freedom to pursue your long-term goals. Let’s start planting your money seeds today!

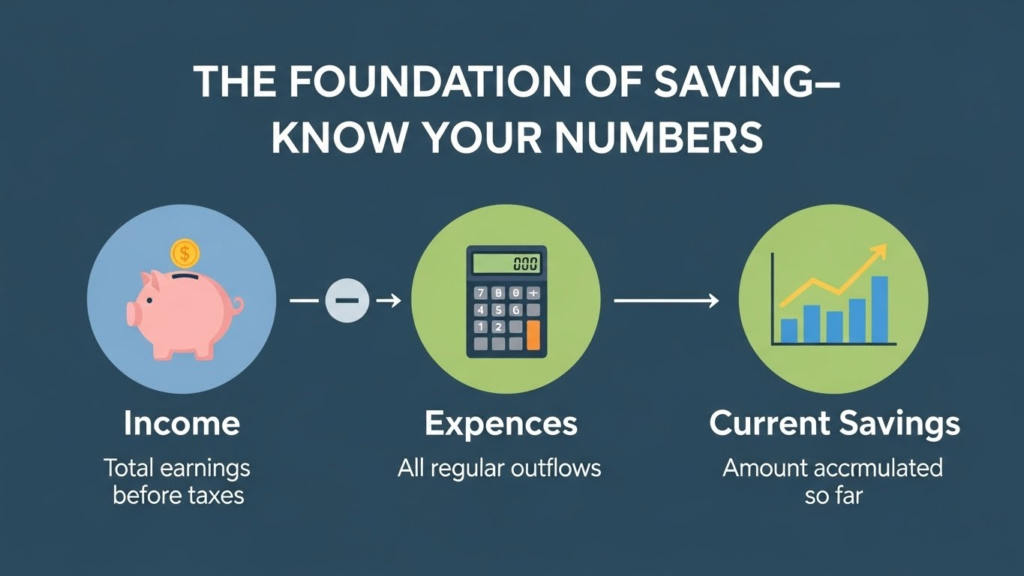

🎯 Phase 1: The Foundation of Saving—Know Your Numbers

Before you can build an effective savings strategy, you must first understand your current financial reality. This is where many beginners stumble.

H2: Mastering the Beginner’s Budget: The Simplest Way

Budgeting doesn’t have to be restrictive or dull. It’s simply tracking your income and your outflow.

- 1. Calculate Your Net Income: This is the money that actually hits your bank account after taxes and deductions. This is your starting point.

- 2. Track Every Expense: For one month, write down or use an app to track every single dollar you spend—from rent to that $5 coffee. Don’t judge the spending yet; just record it. This data is gold.

- 3. Categorize Your Spending: Group expenses into clear buckets: Fixed (rent, car payment), Variable (groceries, entertainment), and Savings/Debt (what you want to put aside).

H3: Introducing the 50/30/20 Rule

For beginners, the 50/30/20 rule is an ideal, easy-to-manage budgeting framework:

- 50% Needs: Essential expenses like housing, utilities, minimum debt payments, and groceries.

- 30% Wants: Non-essential spending like dining out, entertainment, hobbies, and shopping.

- 20% Savings & Debt Repayment: This portion goes toward savings goals (emergency fund, retirement) and extra debt payments above the minimum.

Action Item: If you find your “Needs” are taking up 70% of your income, the first step is to focus on lowering those fixed costs to free up more money for the 20% savings bucket.

🔒 Phase 2: Protecting Yourself—The Emergency Fund

The first and most important savings goal for any beginner is establishing a financial safety net.

H2: Building Your First Financial Safety Net

An emergency fund is a pool of cash set aside for unexpected costs, such as a sudden car repair, a dental emergency, or a temporary job loss. It prevents you from sinking into debt when life happens.

- 4. Set a Target Goal: As a beginner, aim for a “mini-fund” of $1,000–$2,000. This covers most small crises.

- 5. The Ultimate Goal: Once you reach the mini-fund, aim to save 3–6 months worth of living expenses. This is true financial security.

H3: Where to Keep Your Emergency Money

Your emergency fund should be easily accessible but separate from your daily spending money.

- High-Yield Savings Account (HYSA): This is the best place. It’s safe, FDIC-insured, and pays you a significantly higher interest rate than a standard checking account. This makes your money work a little harder.

- Keep It Separate: Crucially, the fund should be held in a different bank or financial institution than your primary checking account. This creates a psychological barrier, making it harder to spend impulsively.

💰 Phase 3: The Secret Weapon—Automation

If you want to know how to save money as a beginner easily, automation is the non-negotiable answer.

H2: Pay Yourself First: Making Savings Non-Negotiable

The traditional method is to spend first and save what’s left. This almost never works. The expert method is to flip this script.

- 6. Automate Your Transfers: Set up an automatic transfer from your checking account to your savings account (your HYSA) to occur the day after your payday.

- 7. Start Small and Grow: If you can only afford to save $50 right now, great. Start there! Once you get a raise or cut an expense, immediately increase that automated transfer amount by $10 or $20. This is called “saving the raise.”

- 8. Treat Savings Like a Bill: View your automated transfer as a fixed utility bill—it must be paid. Since you never see the money in your checking account, you won’t miss it.

(Internal Linking Suggestion: See our article on Automated Investing: Making Your Money Grow While You Sleep)

💸 Phase 4: Cutting Expenses Like a Pro

Once you know your numbers and have automation set up, the next step is finding money hidden in plain sight.

H2: High-Impact Savings: Attacking the Big Three Expenses

The biggest savings are found by tackling the largest budget items: Housing, Food, and Transportation.

- 9. Negotiate Housing Costs (If Applicable): If you’re renting, research local market rates when your lease is up. Sometimes you can negotiate a small reduction or flat renewal rate. If you’re a homeowner, look into refinancing options.

- 10. Shop Around for Insurance: Car insurance and renter’s/homeowner’s insurance must be shopped for annually. Companies rarely reward loyalty; switching providers often saves hundreds of dollars a year.

- 11. Audit Your Subscriptions (The “Subscription Sinkhole”): Go through your bank statement line-by-line and ruthlessly cancel anything you haven’t used in the last month (e.g., streaming services, old gym memberships).

- 12. Lower Your Utility Bills: Practice simple energy-saving steps: turn down the thermostat, use LED bulbs, and seal drafty windows. Every little bit of money saved here adds up.

H3: Easy Wins in Daily Spending

These small changes require minimal effort but provide instant gratification.

- 13. Pack Your Lunch: Buying lunch just three times a week can easily cost $60–$75 a month. Packing a lunch is often 80% cheaper.

- 14. Master the Grocery Store: Always shop with a strict list. Use store loyalty apps for digital coupons. Plan meals around sale items.

- 15. Use the Library for Entertainment: Stop buying books, DVDs, and audiobooks. Your local library is a completely free, excellent resource.

- 16. The “Fake Shopping Cart” Rule: If you want to buy something non-essential online, add it to the cart and close the browser. Wait 24 hours. Most of the time, the urge will disappear.

- 17. Do-It-Yourself (DIY) Maintenance: Learn to handle simple tasks yourself, like changing your car’s air filter or patching small holes in drywall, instead of paying for labor.

🧠 Phase 5: Changing Your Mindset

Saving money is more about psychology than math. The key to long-term success as a beginner is shifting your perspective.

H2: Shifting from Consumer to Investor Mindset

Every dollar you save today is a dollar you can put to work for your future.

- 18. Use the “Hourly Wage Test”: Before buying something, ask yourself: “How many hours did I have to work to afford this item?” This instantly reframes the cost in terms of your time and effort.

- 19. Embrace “Good Enough”: You don’t always need the newest, fastest, or most expensive version of something. A reliable used car or refurbished phone will perform just as well for a fraction of the price.

- 20. Track Your Net Worth (Not Just Income): Begin tracking your total assets minus your total liabilities (debt). Watching this number slowly grow—even if your income stays flat—is a massive motivator. This helps reinforce how to save money as a beginner effectively.

(Related Keywords: financial independence, debt reduction, personal finance goals, budget tracking)

The Saving Journey: Pros & Cons

| Feature | Pros (The Upside) | Cons (The Challenges) |

| Budgeting | Control & Clarity: You gain complete control and know exactly where your money goes. | Initial Effort: Tracking and setting up the budget requires upfront effort and discipline. |

| Automation | Guaranteed Success: Savings happens without needing daily willpower or thought. | Temptation: If you don’t keep savings in a separate account, it’s easy to reverse the transfer. |

| Cutting Wants | Financial Freedom: Creates breathing room and speeds up reaching major goals. | Feeling Restricted: Requires temporary sacrifices that may feel less fun or convenient. |

Key Takeaways for Beginner Savers

- Start Now, Start Small: Don’t wait for the “perfect” time or income level. Even $25 a month is a powerful start.

- Automate Everything: Make savings mandatory by setting up automatic transfers the day you get paid.

- Fund the Emergency Account First: Prioritize that $1,000–$2,000 mini-fund before chasing other goals.

- Focus on the Big Three: The quickest wins come from negotiating housing, reducing food waste, and shopping for cheaper insurance.

- Be Patient: Financial transformation is a marathon, not a sprint. Consistency is the secret ingredient.

Conclusion: Your Financial Future Starts Today

Learning how to save money as a beginner is fundamentally about creating positive habits that put you in control. It’s not about being a miser; it’s about being an architect of your own future.

By applying the principles of the 50/30/20 rule, automating your savings, and making thoughtful choices about your expenses, you are setting a course for financial security and freedom. Consistency is the secret sauce. Every small decision you make today—packing that lunch, canceling that unused subscription, or increasing your automatic transfer—is a brick in the foundation of your future wealth.

Ready to take the next step? Don’t stop at saving; make your money work for you. For guidance on where to put your savings once you hit your emergency fund goal, check out our next article.

Frequently Asked Questions (FAQs)

What is the best savings plan for someone learning how to save money as a beginner?

The best plan for a beginner is the 50/30/20 Rule. It simplifies complex budgeting by allocating your net income into three simple buckets: 50% for Needs, 30% for Wants, and 20% for Savings and Extra Debt Payments. It’s easy to track and adjust as you gain experience.

How much money should I save if I am just starting out?

You should follow two steps: first, save a “mini-emergency fund” of $1,000 to $2,000. This covers most small, unexpected expenses. Once that is done, focus on saving enough to cover 3 to 6 months of all your essential living expenses. This is the cornerstone of true financial security.

When I’m learning how to save money as a beginner, should I prioritize paying off debt or saving?

This is often called the “Save vs. Pay Off Debt” dilemma. As a beginner, you should do both simultaneously. First, save your $1,000 mini-emergency fund. Once that is secured, split your 20% savings allocation. Use part of it to continue funding the main emergency account and the rest to pay down high-interest debt, like credit cards, as fast as possible.

What is the biggest mistake beginners make when trying to save money?

The biggest mistake is inconsistency and failing to automate. Many beginners rely on sheer willpower to transfer money at the end of the month, only to find they spent everything. The solution to how to save money as a beginner successfully is to Pay Yourself First—automate the transfer the moment your paycheck lands, making saving non-negotiable.