Most of us buy car insurance because the law demands it, or because we know the financial devastation an accident can bring. We compare premiums, check off a few boxes, and then quickly file the policy away, hoping we never need it. But here’s a stark truth: your car insurance policy isn’t just a receipt for a monthly payment. It’s a complex legal contract, a detailed roadmap of what your insurer will — and won’t — do when disaster strikes. Ignoring its fine print is like navigating rush hour blindfolded.

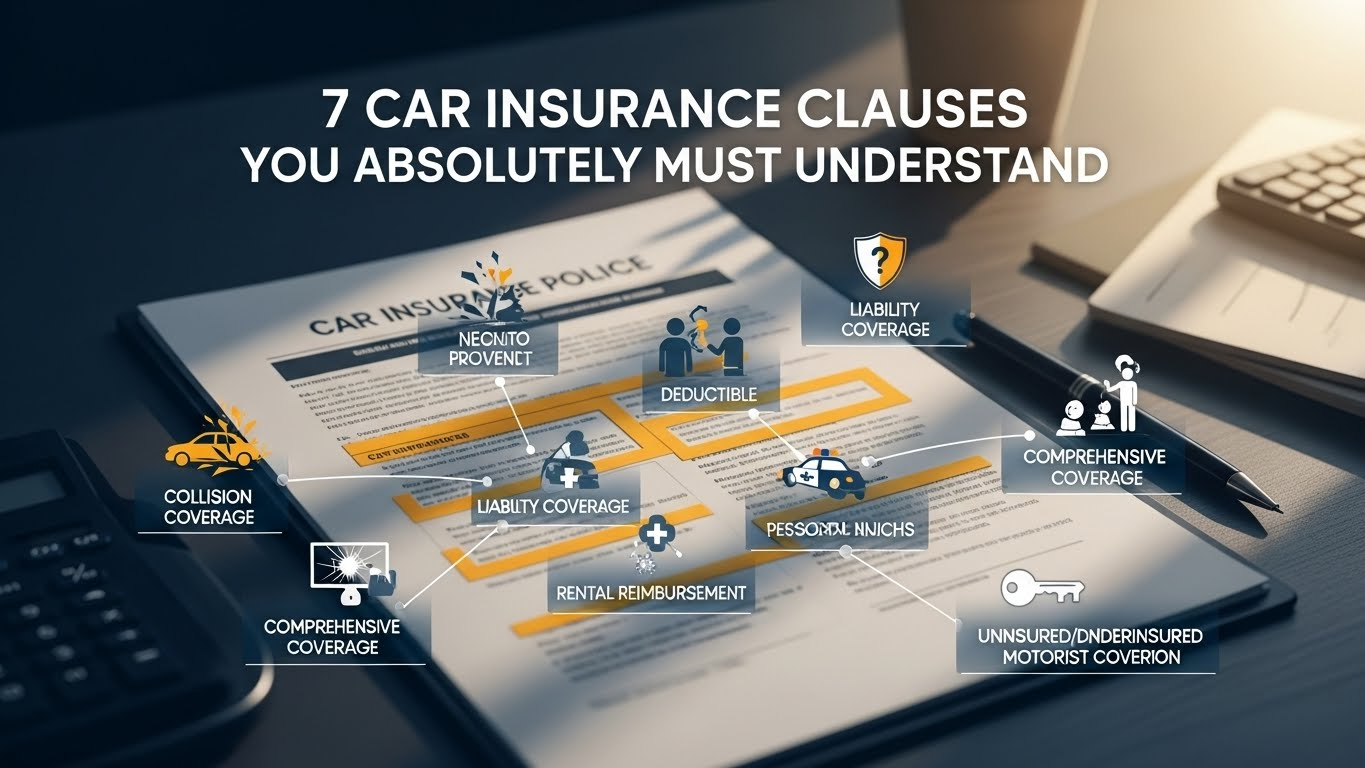

Many drivers pay for coverage they don’t fully comprehend, leaving themselves vulnerable to nasty surprises when they need their policy most. Understanding a few key clauses can be the difference between a smooth claims process and a financial nightmare. Let’s break down the often-overlooked parts of your policy that demand your attention.

1. The Declarations Page: Your Policy’s Snapshot

Before diving into the intricate language, look no further than the “Declarations Page.” This isn’t a clause itself, but it’s the most critical summary document you own. It distills your entire policy into an easily digestible format.

What it is: This page lists your name, address, policy number, policy period (start and end dates), the vehicles covered, and, most importantly, a breakdown of *all* your coverages, their limits, and your deductibles. It also specifies the premium you’re paying.

Why it matters: Think of it as the cheat sheet for your entire policy. It’s where you confirm that your name is spelled correctly, your car’s VIN is accurate, and the coverages you discussed with your agent are actually in place. A mismatch here means your entire policy could be compromised or not cover what you think it does.

Actionable Advice: Every time you receive a new policy or renewal, immediately cross-reference the Declarations Page with your expectations. Is your current address listed? Are all drivers in your household included? Are your liability limits what you remember agreeing to? Don’t assume; verify.

2. Deductibles: Your Out-of-Pocket Contribution

You’ve likely seen the term “deductible” before, especially concerning collision and comprehensive coverage. But do you really grasp how it functions in a real-world scenario?

What it is: A deductible is the amount of money you agree to pay out of your own pocket toward a covered loss *before* your insurance company starts paying. For instance, if you have a $500 collision deductible and your car sustains $3,000 in damage in an accident where you are at fault, you pay the first $500, and your insurer covers the remaining $2,500.

Why it matters: Your deductible directly impacts your premium. A higher deductible generally means a lower premium, and vice-versa. However, choosing a high deductible that you can’t readily afford in an emergency is a dangerous gamble. It can leave you stranded with a damaged car and no funds for repairs.

Unique Insight: Many policies have separate deductibles for collision and comprehensive claims. You might have a $500 collision deductible but a $100 comprehensive deductible (for things like hail damage or theft). Be aware of both, and consider if you have enough in savings to cover the highest one should an incident occur.

3. Liability Coverage Limits: Your Financial Shield (or Lack Thereof)

This is arguably the most crucial part of your car insurance policy, yet many drivers only opt for the bare minimum required by law.

What it is: Liability coverage protects you financially if you’re at fault in an accident. It has two main components:

- Bodily Injury (BI) Liability: Pays for medical expenses, lost wages, and pain and suffering for people injured in an accident you cause.

- Property Damage (PD) Liability: Pays for damage to other people’s vehicles or property (like fences, buildings, streetlights) that you cause.

Coverage limits are usually expressed as three numbers, e.g., 100/300/50. This means:

- $100,000 maximum for bodily injury per person.

- $300,000 maximum for bodily injury per accident.

- $50,000 maximum for property damage per accident.

Why it matters: If you cause a severe accident with multiple injuries or total a high-value vehicle, minimum liability limits will almost certainly be insufficient. The injured parties can sue you for the difference, putting your personal assets (savings, home, future earnings) at risk.

Unpopular Opinion: Minimum liability coverage is rarely enough. The cost to increase your limits significantly is often surprisingly low compared to the catastrophic financial risk of being underinsured. Don’t be penny-wise and pound-foolish here. Seriously consider limits of at least 100/300/100, if not higher, especially if you have significant assets.

4. Uninsured/Underinsured Motorist (UM/UIM) Coverage: Protection from Others’ Irresponsibility

While you might be responsible and carry adequate insurance, many other drivers aren’t. UM/UIM coverage is designed for precisely those situations.

What it is:

- Uninsured Motorist (UM): Pays for your medical expenses and, in some states, property damage if you’re hit by a driver who has *no* car insurance.

- Underinsured Motorist (UIM): Steps in when the at-fault driver has insurance, but their liability limits are too low to cover your medical bills and damages. Your UIM coverage will pay the difference, up to your policy’s limits.

Why it matters: Despite laws requiring insurance, a significant percentage of drivers on the road are uninsured or carry minimal coverage. If one of them hits you, and you don’t have UM/UIM, you could be left with enormous medical bills or car repair costs that your own health insurance or collision coverage might not fully cover, or worse, leaving you to sue an un-insurable party.

Specific Example: Imagine a driver with minimum state liability hits you, causing $75,000 in medical bills and $15,000 in lost wages. If their liability only covers $25,000 per person, your UIM coverage would kick in to cover the remaining $50,000 (medical) and $15,000 (wages), assuming your UIM limits are high enough.

5. Exclusions and Limitations: What Your Policy *Won’t* Cover

This is where many policyholders get an unpleasant awakening. Every insurance policy contains clauses that explicitly state what is *not* covered.

What it is: Exclusions are specific circumstances or types of damage that your policy won’t pay for. Common exclusions include:

- Intentional acts: You intentionally damage your car or someone else’s.

- Racing or stunt driving: Accidents occurring during illegal street racing or professional competitions.

- Using your personal car for business (without specific endorsements): If you use your personal vehicle for ridesharing, delivery services, or commercial purposes, your standard personal policy likely won’t cover accidents during those activities.

- Wear and tear: Routine maintenance items or gradual deterioration of parts are not covered.

- Modifications not declared: Significant alterations to your vehicle (e.g., performance upgrades, custom paint) might not be covered unless explicitly listed and insured.

Why it matters: Not understanding exclusions can lead to claims being denied outright, leaving you with 100% of the financial burden. If you’re using your car for something other than typical personal transport, you *must* check these clauses.

Unique Insight: Pay particular attention to the “named driver” clause. If an unlisted driver uses your car and gets into an accident, your policy might deny the claim, especially if that driver regularly uses your vehicle or lives in your household.

6. Policy Term and Cancellation Clauses: Keeping Your Coverage Active

It might sound basic, but understanding when your policy starts, when it ends, and how it can be canceled is fundamental to continuous coverage.

What it is:

- Policy Term: The period your insurance contract is active, typically six months or a year. Your Declarations Page will clearly state the start and end dates.

- Cancellation Clauses: These detail the conditions under which either you or the insurer can cancel the policy. Insurers can cancel for reasons like non-payment, fraud, or significant changes to your risk profile (e.g., multiple serious accidents or DUIs). You can cancel at any time, usually with a prorated refund of any unused premium.

Why it matters: Lapses in coverage can have serious consequences. Driving without insurance, even for a single day, can lead to fines, license suspension, and severe financial risk if you’re in an accident. If an insurer cancels your policy, it can be harder and more expensive to find new coverage.

Actionable Advice: Always ensure you have continuous coverage. If you switch insurers, make sure the new policy starts the day the old one ends. If you face non-renewal or cancellation, act immediately to secure new coverage to avoid legal penalties and higher premiums later.

7. Notice Requirements & Claims Procedure: Your Obligations After an Accident

An accident is stressful, but what you do (or don’t do) immediately afterward can profoundly impact your claim’s success. Your policy outlines your responsibilities.

What it is: This clause details the steps you must take following an incident to ensure your claim is valid. Typically, these include:

- Prompt notification: You must notify your insurer “as soon as practicable” or “within a reasonable time” after an accident. Delaying notification can sometimes jeopardize your claim.

- Cooperation with investigation: You must cooperate fully with your insurer’s investigation, providing statements, documents, and allowing vehicle inspection.

- Protecting the vehicle from further damage: After an accident, you have a duty to prevent additional damage to your vehicle (e.g., covering a broken window to prevent rain damage).

- Not admitting fault: Your policy will often state you should not admit fault or make payments without the insurer’s consent.

Why it matters: Failure to follow these steps can give your insurer grounds to deny your claim or reduce your payout. It’s a contractual obligation.

Specific Example: If you get into a fender bender, exchange information, and then wait three weeks to tell your insurer because you were busy, they might question the validity of the claim or the extent of the damage, potentially complicating or denying coverage.

—

Reading your car insurance policy won’t ever be as exciting as a cross-country road trip, but it’s infinitely more important for your financial security. Don’t let confusing jargon deter you. Take the time to review these seven crucial clauses. Understand what you’re buying, what you’re protected against, and what’s expected of you. Your future self, and your wallet, will thank you for it.