Are your finances a tangled knot you can’t quite untie? Does the thought of budgeting feel like a straitjacket, restrictive and joyless? You’re not alone. Many people grapple with managing their money effectively, often feeling overwhelmed by complex spreadsheets or unrealistic savings goals. But what if there was a simple, intuitive framework that could bring clarity and control back to your bank account, without demanding extreme sacrifices?

There is. The 50/30/20 Budget Rule offers a refreshingly straightforward path to financial stability and, ultimately, genuine financial freedom. It’s a powerful tool, championed by Senator Elizabeth Warren in her book *All Your Worth: The Ultimate Lifetime Money Plan*, designed to simplify your money management into three clear categories. This isn’t about deprivation; it’s about smart allocation. We’ll walk through exactly how to apply this rule to your life, demystify its components, and help you forge a stronger financial future.

The Promise of Financial Control

Imagine knowing precisely where every dollar goes each month. Envision having dedicated funds for your rent, your evenings out, and your retirement, all without endless calculations. That’s the core promise of the 50/30/20 Budget Rule. It offers a balanced approach, acknowledging both life’s necessities and its pleasures, while prioritizing your long-term wealth. This method isn’t just about saving; it’s about spending with purpose and building a solid foundation.

Deconstructing the 50/30/20 Budget Rule

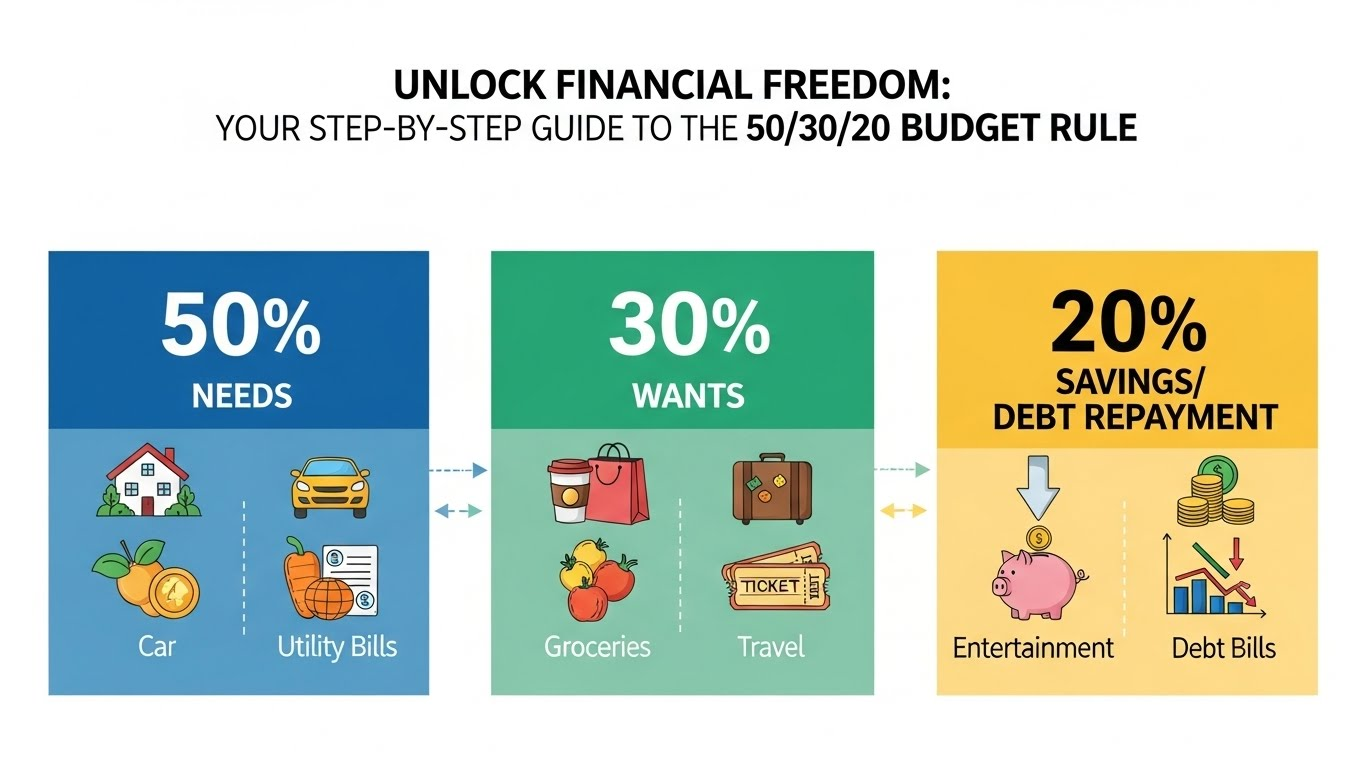

At its heart, the 50/30/20 Budget Rule dictates how you should allocate your *after-tax* income: 50% to Needs, 30% to Wants, and 20% to Savings & Debt Repayment. Let’s break down each component thoroughly.

50% for Needs: Your Essential Spending

Fifty percent of your take-home pay should cover your absolute necessities – the expenses you literally cannot live without. Think of these as the non-negotiables that keep a roof over your head and food on your table.

- Housing: Rent or mortgage payments. Property taxes and homeowner’s insurance also fall here.

- Utilities: Electricity, gas, water, internet – the essentials to keep your home functioning.

- Groceries: Basic food supplies needed for sustenance. This does *not* include dining out or fancy take-away.

- Transportation: Car payments, gas, public transit fares, essential car insurance. What gets you to work or essential appointments.

- Healthcare: Insurance premiums, necessary prescription costs.

- Minimum Debt Payments: The absolute minimum payments on credit cards, student loans, or personal loans. We’ll address accelerating debt repayment in the 20% category, but the minimums are non-negotiable needs.

A crucial insight here: if your ‘Needs’ regularly exceed 50% of your net income, it signals a deeper structural issue. You might need to consider downsizing housing, finding cheaper transportation, or exploring ways to increase your income. The 50/30/20 Budget Rule exposes these imbalances clearly.

30% for Wants: The Lifestyle Element

This is where life gets a little more fun. The 30% category is for all the discretionary spending that enhances your life but isn’t strictly necessary for survival. This distinction is vital for successful budgeting with the 50/30/20 Budget Rule.

- Dining Out & Take-away: Any meals eaten outside your home, or ordered in.

- Entertainment: Movies, concerts, streaming services, video games.

- Hobbies & Recreation: Gym memberships (beyond basic health needs), sports equipment, craft supplies.

- Vacations & Travel: Leisure trips and getaways.

- Shopping: New clothes, gadgets, home decor that isn’t essential.

- Upgrades: A faster internet package when a basic one suffices, premium coffee instead of brewing at home.

It’s easy to let wants creep into the needs category. A designer coffee every morning feels like a need to some, but it’s undoubtedly a want. Being honest with yourself in this category is key to making the 50/30/20 Budget Rule effective. This 30% ensures you still enjoy life and avoid feeling deprived, which is a common reason why other budgets fail.

20% for Savings & Debt: Building Your Future

This 20% is arguably the most impactful portion of the 50/30/20 Budget Rule. This is where you actively build wealth and dismantle financial burdens.

- Emergency Fund: Essential savings to cover 3-6 months of living expenses. A critical buffer against unexpected job loss or medical emergencies.

- Retirement Contributions: 401(k), IRA, Roth IRA – invest for your golden years.

- Down Payments: Saving for a house, car, or other significant purchases.

- Investment Accounts: Brokerage accounts for long-term growth.

- Extra Debt Payments: Anything *above* the minimum payments on high-interest credit cards, student loans, or personal loans. Aggressively paying down debt here frees up future income.

Implementing the 50/30/20 Budget Rule: A Practical Walkthrough

An unpopular opinion on the 50/30/20 Budget Rule: don’t wait until all your debt is paid off to save for retirement. Even a small contribution to retirement *while* paying extra on debt can leverage compounding interest in your favor, especially if your employer offers a match. Missing out on that free money is a costly mistake.

Theory is great, but application is everything. Here’s how you put the 50/30/20 Budget Rule into action.

Pinpointing Your Net Income

Your starting point is your take-home pay – the money that actually hits your bank account after taxes, insurance, and retirement contributions (if pre-tax) are deducted. If your income fluctuates, use an average of the last three to six months, or base your budget on your lowest expected income to be safe.

Categorizing Expenses with the 50/30/20 Budget Rule in Mind

Gather all your bank statements, credit card statements, and receipts from the past month or two. Go line by line and assign each transaction to either “Need,” “Want,” or “Savings/Debt.” This step can be eye-opening. You’ll quickly see where your money truly goes.

Example Categorization:

- Rent: Need

- Netflix subscription: Want

- Student loan minimum payment: Need

- Extra student loan payment: Savings/Debt

- Groceries: Need

- Dinner with friends: Want

- Contribution to emergency fund: Savings/Debt

- Car insurance: Need

- New pair of shoes: Want

- Gas for commuting: Need

Tracking and Adjusting

Once you’ve categorized everything, calculate the percentages. Did you spend 70% on wants and only 10% on savings? Don’t panic. This is information, not judgment. The goal is to bring those percentages in line with the 50/30/20 Budget Rule.

Tools for tracking:

- Spreadsheets: Google Sheets or Excel offer full customization.

- Budgeting Apps: Mint, YNAB (You Need A Budget), PocketGuard – many offer automated categorization and visual breakdowns.

- Pen and Paper: Simple, effective, and forces you to engage directly with your numbers.

Review your budget weekly or bi-weekly. Life changes, and so should your budget. Did an unexpected expense throw you off? Adjust your ‘Wants’ for the rest of the month. Did you get a bonus? Direct it to ‘Savings/Debt’. This flexibility is one of the strengths of the 50/30/20 Budget Rule.

Common Missteps and How to Navigate the 50/30/20 Budget Rule Successfully

Even with its simplicity, people often hit snags. Understanding these common pitfalls helps you sidestep them.

The Income Fluctuation Challenge

For freelancers, commission-based earners, or those with seasonal work, a fixed income budget can be tough.

Solution:

- Base on Lowest Income: Set your budget using your lowest expected monthly income. When you have a higher-earning month, funnel the surplus directly into your 20% savings and debt repayment, or create a buffer fund for leaner months.

- “Bucket” Your Income: As income arrives, immediately assign it to its 50/30/20 buckets, rather than waiting until the end of the month.

Want vs. Need: A Tricky Distinction

This is where many budgets fall apart. It’s easy to rationalize a want as a need. For example, a car payment is a need, but upgrading to a luxury car beyond your means turns that need into an excessive want that eats into your 50% category.

Solution: Be brutally honest. Ask yourself: “Could I survive without this item or service?” If the answer is yes, it’s a want. Remember, the 50/30/20 Budget Rule isn’t about judging your choices; it’s about making them consciously.

Overcoming Initial Resistance to the 50/30/20 Budget Rule

Budgeting can feel restrictive at first. You might miss impulsive purchases or feel like you’re constantly saying no to yourself.

Solution:

- Start Small: Don’t try to be perfect from day one. Aim for progress, not perfection. Maybe your first month is 60/25/15. Identify areas to trim and work towards the target percentages over a few months.

- Focus on the “Why”: Remind yourself *why* you’re doing this. Financial freedom, peace of mind, that future vacation, early retirement – keep your goals front and center.

- Automate Savings: Set up automatic transfers to your savings and investment accounts on payday. “Pay yourself first” is a cornerstone of the 50/30/20 Budget Rule and overall financial success.

Adapting the 50/30/20 Budget Rule to Your Unique Life

While the 50/30/20 framework is robust, it’s not a one-size-fits-all straitjacket. Your personal circumstances might require minor adjustments.

- High Cost of Living Areas: If your needs (rent, etc.) genuinely consume more than 50% due to an expensive city, you might have to temporarily adjust the ‘Wants’ category downward (e.g., 55/25/20). The priority is still to hit that 20% for savings and debt.

- Low Income: If your income is very low, 50% might not even cover basic needs. In such cases, the focus shifts to maximizing income and minimizing needs as much as possible, while still trying to put *something* towards the 20%. Even 5% or 10% is better than nothing.

- High Income: For high earners, 20% for savings might feel too low. You have the flexibility to invert the savings/wants (e.g., 50/20/30 or even 50/10/40) to accelerate wealth building significantly. The core principle of the 50/30/20 Budget Rule remains: conscious allocation.

The power of the 50/30/20 Budget Rule isn’t its rigidity, but its flexibility as a guiding principle.

Beyond the Basics: What’s Next After Mastering the 50/30/20 Budget Rule?

Once you consistently apply the 50/30/20 Budget Rule and feel confident in your allocations, you might wonder what comes next.

1. Optimize Your Savings: Ensure your 20% isn’t just sitting in a low-interest savings account. Are you maximizing employer 401(k) matches? Are you investing in low-cost index funds?

2. Accelerate Debt Payoff: If you have high-interest debt, consider directing more of your ‘Wants’ money (temporarily) to obliterate that debt faster. This frees up future income for more aggressive savings and investments.

3. Future Goal Planning: With your budget under control, you can start setting more specific, larger financial goals: a down payment on a house, starting a business, early retirement. The 50/30/20 Budget Rule provides the consistent cash flow needed to fund these ambitions.

4. Educate Yourself: Continue learning about personal finance, investing, and tax strategies to grow your wealth even further.

Your Path to Financial Freedom Starts Now

Implementing the 50/30/20 Budget Rule isn’t a magic bullet, but it is a profoundly effective framework for transforming your financial life. It’s a tool for awareness, discipline, and ultimately, empowerment. By consciously allocating your income to needs, wants, and future goals, you stop reacting to your money and start directing it. Take the first step today: calculate your net income, categorize your last month’s spending, and start sculpting your financial future with the clarity and control the 50/30/20 Budget Rule provides. Your financial freedom awaits.